Blogs - knowledge spot

Western Europe Photo Printing Sector Returns to Value Growth

Apr 12, 2021

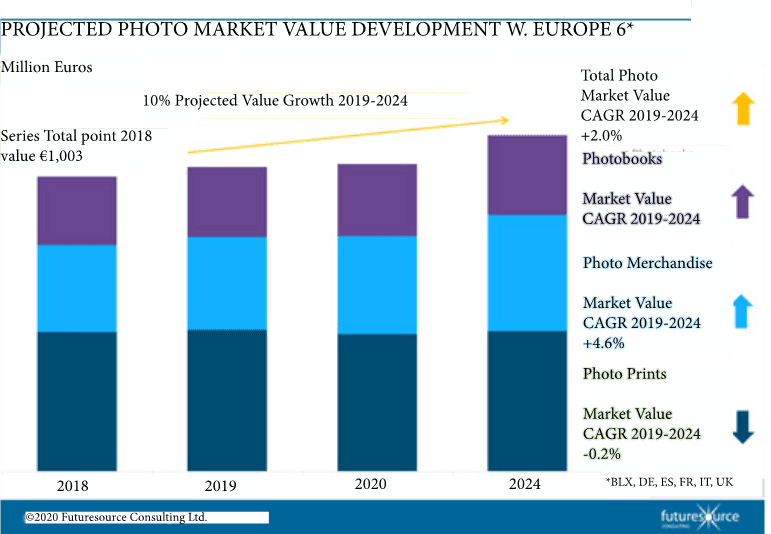

According to a July 2020 study by Futuresource during the peak of COVID-19 infections in Europe, Western European Photo output value is rising, driven for the first time in many years by all three Photo categories (Photo Prints, Photobooks and Photo-Merchandise). This study, covering the top-6 markets in Western Europe (Benelux, France, Germany, Italy, Spain and the UK, which account for 75%+ of total Western European Photo market value) details the progress of this sector in recent years and provides an outlook to 2024.

COVID-19 lockdowns in the first half of 2020 and retail closures during this period had an impact on retail (on-site) photo orders. Some customers moved online instead, leading to fears among retailers that they will not recover all of this business. A significant shake-out in the retail minilab installed base since the beginning of 2019 has also contributed to the continuing on-site photo printing decline, although the (retail) instant print photo kiosk sector remains buoyant in many Western European markets.

Photobooks

There was some significant growth in photobook and some photo-merchandise orders during the spring of 2020, driven by consumers at home with time on their hands. (Indeed, some retailers reported acquiring new customers by up to 30% during the first half of 2020). However, retailers saw some slowdown in June and July, as lockdowns eased, but this was expected to rebound as lockdowns were again imposed.

The photobook market is coming a bifurcated sector, with larger, lay-flat books with high quality digital paper and printing, or printed on silver halide photo paper, often with a rising average number of pages for repeat customers driving value at the top-end – manufactured with high-speed automated equipment like the systems from Layflat.com - while “ready to use” (targeting social media) or “quick to create”, app-based photobooks are gaining volume traction at the lower-cost end of the market. The overall 2020 outlook for photobooks was an 8% volume rise (this has not been confirmed), although price competition during 2020 was expected to push the ASP (Average Selling Price) down in 2020 (and restrict value growth to ~3%).

Prints

For several years now, the Millennials and Gen-Z have shown an interest in photo prints, having grown up in an era of digital imaging. This has partially been driven by the success of overall, and particularly the popularity among these demographics of instant print cameras, (e.g.: Fujifilm, Polaroid), which then sometimes lead them to instant print photo kiosk printing in-store, or web-to-home orders, as they seek a higher quality image. It is not uncommon for several photo prints to be used as wall décor and changed regularly. These demographics are generally not large volume customers, and are therefore relatively agnostic to high instant print photo kiosk prices (2020 Average Selling Price €0.39 per print) or ordering a set of retro or square photo prints from a website or app, which carry a much higher price than the 10x15cm online photo print average price of around €0.14 (2020) across the Western Europe-6 region.

Photo Merchandise

Photo Merchandise volume was expected to rise by 10% in 2020, riding on the first half 2020 “lockdown” spike, but price competition will deliver a lower, 6% value rise (relatively in line with 2019). Photo cards (and general web-to-print greetings cards) took a huge upswing in the first half of 2020. This was felt especially in the UK, Benelux region and Germany, where greetings cards are the most popular, as consumers were not able to purchase cards from retailers. There are hopes that some of these new customers will become permanent e-commerce customers for web-to-print cards (including photo cards) and for non-photo gifting.

The rise of the ‘fleet of foot’ photo app is still on the radar of the wider photo industry with Cheerz, Free Prints, Free Prints Photobooks, LaLaLab, Popsa and ReSnap being examples of these apps. Indeed, some of these more recent app-based resellers have been integrated into existing photo brands or print service providers (e.g.: Albelli, CEWE, Photoweb). However, the cost to optimize for apps and HTML-5 web orders across iOS & Android, coupled with a website offering, is not always palatable to larger players, which offer a much deeper range of SKUs. There is also a concern that many consumers do not want to have apps that they only use occasionally “cluttering up” their Smartphones. Layflat.com systems can be used by all printing companies for manufacturing premium LayFlat photobooks.